How often do you find yourself wishing that you had a little more spending money?

When it comes to saving money in Sydney, the right approach can get you pretty far. Given that Sydney is one of the most expensive cities in the world, saving money is a no-brainer – some reports estimate that the average living cost for one person in Australia more broadly is almost $3000 a month – a figure that is even higher in Sydney. Not to mention, Sydney’s median property price at the start of 2020 was an unbelievable $872,934.

Clearly, knowing how to save your cash in Sydney is a no brainer. With this being said, here are our top money saving tips based on your situation, expenses, lifestyle, and the city of Sydney itself.

Sydney Money Saving Tips of 2021: An Overview

If you are looking for a quick rundown of the best ways to save money in Sydney, here is everything that this article covers:

- Quick money saving tips that you can get done ASAP

- Budgeting rules:

- The 50/20/30 rule

- The 30 day rule

- Making small changes that add up

- Spending less while shopping

- Cutting down on bad habits

- Taking advantage of cheap deals and free stuff

- Making use of financial tools and apps

- Changing where you spend your money

- Knowing how to earn interest and grow your savings

Quick Tips: 10 of the Best Ways to Save Money in Sydney

- Get an Opal card – Sydney’s public transport system will get you wherever you want to go, quickly and cheaply.

- Keep the costs down during your weekend nights – buy from the bottle-o instead of the bar, and go out during happy hour!

- Become a bargain hunter – eBay and Gumtree are always worth checking out.

- Keep your date night costs down by checking out the free Sydney art galleries, affordable pubs and occasional city events.

- You don’t have to leave a tip – unless you really want to.

- Ditch the car for a bike – in Sydney, bike lanes are popping up all over the place.

- Cut down on morning coffees – a daily $4 coffee adds up to $28 a week, or almost $1500 a year.

- Move your gym routine to your home – Sydney gyms can be expensive, but body weight exercises are completely free.

- Start keeping track of your expenses. Knowing where you are spending money is the first step in cutting down on costs.

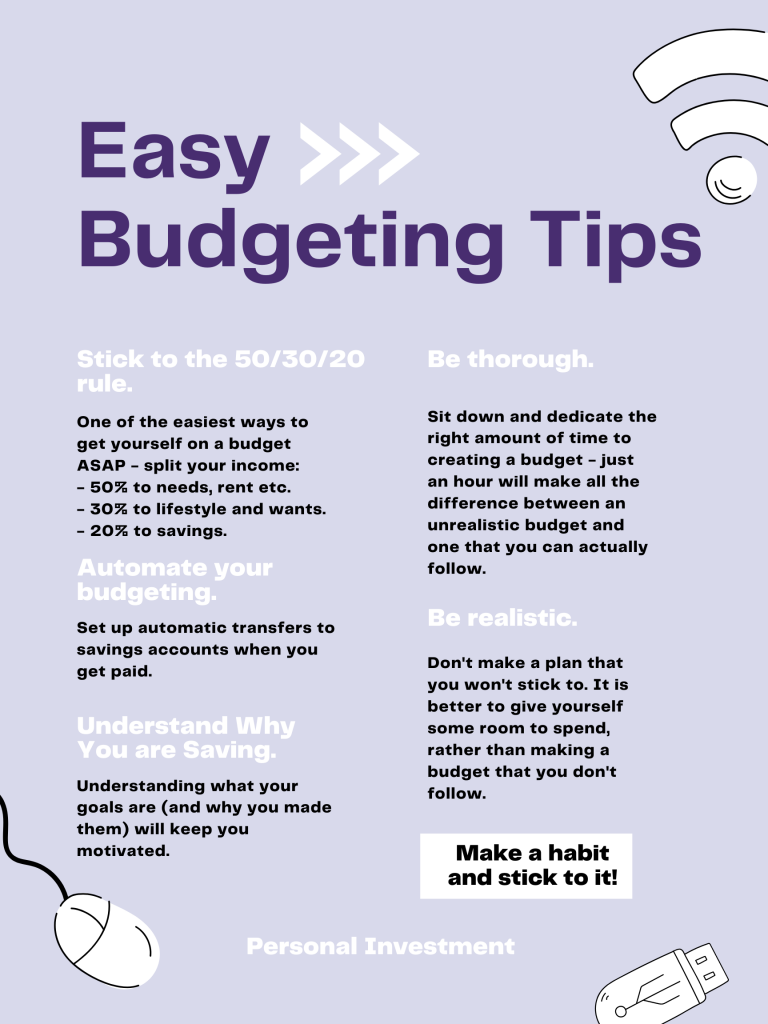

- Make a budget, and keep it realistic, achievable, and effective.

Cutting Expenses and Saving Money With Budgeting

In reducing expenses and saving money in Australia, a right approach will involve both changing your lifestyle, and sticking to a clear plan regarding what happens with your income as you receive it.

In addition to ongoing habits you can make and approaches you can take, there are a couple of rules or challenges that result in significant savings and a renewed approach to saving money.

Budgeting is the most crucial part of any savings plan. We have split the process up into three sections, so that the process is as straightforward as possible.

Setting Goals

This is the most important step, and it’s not as difficult as you might think.

- The first thing to do is decide how much money you want in your savings account at the end of one year – this will be your goal amount.

- Next, set a date for when that dollar amount should be reached – let’s say December 31st 2017.

- Now we need to figure out what needs our attention each month so that we can get there on time!

How to Set Monthly Financial Goals

It’s a good idea to plan out how you want your money to be spent each month, which will help ensure that it goes where we need it. This might involve setting spending limits in certain categories, aiming to cut down on regular expenses, and setting monthly goals.

Start with some goals: Below are some suggested areas of focus for the months ahead:

- January – Start an emergency fund and set up a budget!

- February – Review your credit card balances and make an effort not to spend too much on them this month

- March – Pay off any loan debt as fast as possible; checking if there’s anything else in life you can do without while still saving money (e.g., cancelling cable)

- April – Save at least $500 per month from now until December 31st 2021

…and so forth!

Creating a Monthly Budget

To calculate how much money needs to be allocated every month, a good approach is to take your monthly income and subtract all necessary expenses like rent/mortgage payments or bus fares (whichever takes up the largest chunk).

With the money you have left over, you’ll need to decide what is allocated to spending on wants, and what is allocated to your savings. The more you want to save, the less of your money will be spent on wants.

Bonus approach: A great potential goal might be to make sure that at the end of one year, what’s in your savings account matches or surpasses what you’ve allocated each month.

Why a Budget is Important

Building a budget and following it can seem tedious, but when you break the process down into manageable steps, you’ll see how beneficial it is to have one.

A monthly budget will keep your spending in check by clearly defining what’s set aside for wants and needs. Paying attention to where your money goes each month will also help curb impulse purchases.

If for any reason there are unforeseen expenses during the month (for example if something breaks), a budget also helps to know how much money has already been allocated for those things so as not to spend too much extra when unexpected events happen.

What is the 50/30/20 Rule?

When it comes to financial advice, one of the most fundamental money saving rules is the 20/30/50 rule – this is the easiest and quickest way to see consistency, self-control and quick savings.

The 50/30/20 budget rule is a simple and effective percentage based approach to budgeting, eliminating the need for complicated budgeting categories. It involves splitting your after-tax income into just three sections:

- 50% of your income is spent on needs

- 30% of your income is spent on wants

- 20% of your income is spent on savings and paying off debt

In this case, your needs will include all living expenses (rent, utilities, food, transportation, clothing, minimum repayments on debt). Wants will include lifestyle choices that range from movie tickets and holidays, to pets and gym fees. Finally, 20% of your income should be dedicated either to your savings or to paying off debt, if you have any. Ultimately, the 50/30/20 rule is the best approach when it comes to how to save money in Sydney.

Setting Up Automatic Transfers

Once you have set out a budget, one of the best ways to stick to this budget is by setting up an automatic transfer: every week, month (or any regular interval – whatever suits your lifestyle), take a set amount from your pay-check and transfer it into a savings account.

Depending on the financial institution or banking app that you use, you might even be able to split this up into savings categories – this will allow you to fine tune your savings even more.

It’s surprisingly easy to do this and if you’re living with someone, that person can also set up an automatic transfer so the two of you are both saving for your future!

The 30 Day Rule

The 30 Day Budgeting Rule is a simple guideline for how to spend your money in Sydney.

It’s based on the fact that you should not budget more than one month of income at any time, and then budget only what is left over after accounting for all previous spending commitments – think about things like like housing, transportation costs, etc.

- Put together a monthly plan with an estimate of your take home pay – break up this amount into weekly budgets where necessary.

- Forecast expenses by estimating bills first and providing some buffers for things like food and entertainment as required.

- Look out for peaks (e.g large car repair expenses) which may require unpaid leave from work or borrowing against savings/borrowing from family members

- Finally, if you want to cut expenses in other areas of spending, there are a few things you can do. This can range from not eating out, to more complex approaches like renegotiating a contract for services that you are no longer using (e.g cancelling cable subscriptions).

Here is an overview of key points:

- Estimate take home pay

- Calculate monthly budgets

- Break up your budget into weekly allocations

- Forecast expenses by estimating bills, rent, fuel – provide buffers where necessary

- Look out for peaks in expenses, unpaid leave from work, and whether you can borrow from family members if necessary.

- Think about how you can reduce spending within each area of your 30 day budget, whether these are ongoing changes or one-offs.

- Review your approach over 30 days, and make changes where necessary.

How to Spend Less While Shopping

- Plan your shopping list.

- Bring your own shopping bags with you.

- Make sure that you aren’t shopping when you are hungry!

- Look out for discounted items that you can make use of before their used by date.

- Shop for groceries at the supermarket, not discount supermarkets or convenience stores.

- Be aware of how you shop – use baskets instead of trolleys to avoid impulse buys.

- Buy in bulk where possible e.g soda drinks and toilet paper.

How to Save Money on Your Utilities

- Switch off appliances such as lights, your TV, and your computer after use – unplug them from the wall socket overnight, too.

- Make sure to keep doors and windows closed during winter months.

- Invest in a programmable thermostat – this will automatically adjust heating and cooling where necessary, depending on activity in the house and external temperatures.

- Consider installing timers which allow different parts of your home to be powered down overnight (e.g your TV) while others continue running (such as kitchen appliances).

- Try to shift over to using blankets, rather than heaters!

How to Spend Less While Eating Out

- Eat out for lunch instead of dinner – if you have a packed lunch at work, this will save money and time.

- If you go out with friends or family members make sure that everyone pays their own way.

- Take advantage of specials in restaurants by booking ahead.

- Order the children’s menu.

- Look up menus online before going so see how much it costs per meal and what is included in each dish (soda drinks/coffee) etc then order accordingly when you are there!

How to Earn Interest on Your Savings

A final way to improve on your savings habits in Sydney and save money is to learn how you can earn interest on your savings:

- Open an online savings account with a different bank.

- Switch your credit card to one that pays interest on cash balance, or find a free checking account and use it as your primary bank account so you are more likely to keep up with the minimum balance requirements.

- Invest in term deposits for fixed periods of time – banks will offer higher rates if they know how long you want them for.

- Use a high-interest earning money market fund instead of low-yield bond funds or GICs (government guaranteed investments).

- Depending on how risk averse you are, you could consider riskier investments such as cryptocurrency.

Questions About Saving Money in Sydney

What is the quickest way to save money?

Ultimately, the quickest way to save comes in your attitude to spending – you need to buy less. Can’t afford to buy organic apples? Buy generic, peel them and cut the corners off for a quick snack that’s healthier as well. Instead of buying a $3 coffee every day, learn how to make your own at home.

How much should I save each month?

There’s no set amount, but the more you save each month, the better off you’ll be.

Saving $400 per month over five years will result in a nest egg of about $40,000 (with interest) – that’s enough for a down payment on an average home or tuition to put your kids through university.

Is it harder to save in certain countries?

Yes. In countries like the United States, Canada and Australia where there are high rates of employment or a booming economy, it’s much easier to save money. With this being said, you’ll need to consider living costs and other factors as well.

Conclusion: Spend Less and Make Your Dollar Go Further

In Sydney, there is no shortage of ways to spend money.

The cost of living in Sydney is high, and it’s hard to save up anything when the bills are coming in so quickly. Whether we’re travelling around or looking at all those shops on our way home from work every day – spending seems inevitable.

However, in order to ensure financial security when planning for retirement (or whatever goal), people need to learn how they can save money without having a major impact on their day to day lives: this will likely be a gradual process, but once achieved, you’ll find yourself feeling infinitely more secure and happy knowing that you have a consistent cash flow, directly into your savings account!

It can be tempting to just get a credit card or take out a loan, but this will only make your situation worse. There are plenty of ways to make saving easy; all it takes is some creativity and discipline!